Making money is no short-lived race, but rather a lifelong marathon. It involves continuous planning, decision-making, and frugal living to ensure financial stability and prosperity. In this article, we will delve into the long-term challenges of money-making, exploring various aspects that individuals need to consider for a successful financial journey. From managing debt and investments to navigating the ever-changing job market, let’s embark on this financial marathon together.

1. The Debt Dilemma

One of the most significant challenges in money-making is managing debt. Whether it is student loans, mortgages, or credit card debt, high-interest payments can be burdensome on one’s financial health. Developing a strategic plan to pay off debt, prioritizing high-interest loans, and reducing unnecessary expenses enables individuals to tackle this challenge head-on. Additionally, setting a budget and being disciplined about sticking to it can help avoid accumulating further debt.

Another crucial aspect of debt management is understanding the implications of various loan options, such as fixed and variable interest rates. Analyzing interest rates and repayment terms before committing to any loan helps individuals make an informed decision while considering their long-term financial goals.

2. The Art of Saving

Building a substantial savings account is crucial for financial stability and being prepared for unexpected expenses or emergencies. However, saving money requires discipline and sacrifice. It involves cutting back on unnecessary expenses, setting realistic savings goals, and automating savings deposits to avoid temptation. Consistently monitoring expenses and finding ways to save, such as taking advantage of discounts and negotiating better deals, can significantly contribute to long-term monetary growth.

Moreover, understanding the power of compound interest encourages individuals to start saving early. Investing in retirement accounts like 401(k)s or individual retirement accounts (IRAs) maximizes the potential returns over time, ensuring a comfortable retirement.

3. Investing Wisely

Investing is a vital component of wealth creation. While investment opportunities come with risks, they also offer the potential for significant returns. Diversifying investment portfolios across different asset classes, such as stocks, bonds, and real estate, helps spread risk. It is essential to research and understand investment options, consult professionals, and stay updated with market trends to make informed decisions.

In the long run, investing in low-cost index funds is a popular strategy advocated by many experts. These funds provide broad market exposure, consistent returns, and lower fees compared to actively managed funds.

4. Navigating Career Challenges

The job market is constantly evolving, presenting individuals with both challenges and opportunities. To adapt and succeed in such a dynamic environment, developing versatile skills and continuously upgrading one’s knowledge are essential. Embracing lifelong learning through courses, certifications, and new experiences allows individuals to remain competitive and relevant.

Another aspect of navigating career challenges is negotiating fair compensation. Researching industry salary benchmarks, demonstrating one’s skills, and articulating the value they bring to the table can help individuals secure higher income and financial stability.

5. The Pitfalls of Lifestyle Inflation

As individuals start earning more money, it is natural to want to upgrade their lifestyle. However, succumbing to lifestyle inflation, where expenses rise in proportion to income, can hinder long-term financial growth. Spending mindfully, setting a budget, and distinguishing between essential and discretionary expenses are crucial to avoid falling into this trap.

Additionally, planning for the future, such as saving for retirement or setting up an emergency fund, allows individuals to balance enjoying the present while securing their financial future. Being mindful of the financial goals and ensuring that increased income aligns with those goals is key to successful money-making.

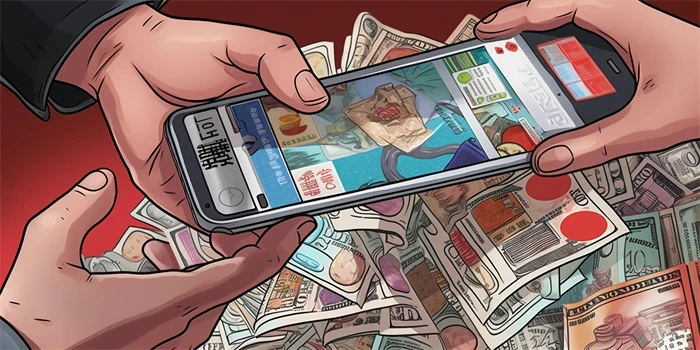

6. Embracing Technology and Automating Finances

The digital age has transformed the way we manage our finances. Embracing technology, such as mobile banking apps, budgeting tools, and investment platforms, can simplify money management and increase transparency. Automating bill payments, savings, and investments not only saves time but also reduces the likelihood of missed payments or impulsive spending.

However, it is crucial to remain vigilant against cyber threats and maintain strong security measures to protect personal and financial information. Regularly reviewing transactions, monitoring credit scores, and implementing multi-factor authentication are essential practices in the technologically-driven financial landscape.

7. Balancing Present and Future Financial Priorities

Finding the right balance between meeting current financial obligations and planning for the future is a challenge many individuals face. While it is essential to prioritize savings and investments, neglecting present needs can lead to dissatisfaction and burnout. Allocating a portion of income towards enjoying life today while ensuring ample savings for tomorrow strikes a healthy financial balance.

This balance can be achieved through efficient budgeting, regularly reassessing financial goals, and adjusting saving and spending patterns accordingly. Seeking professional financial advice can also provide guidance in making informed decisions that align with long-term objectives.

8. Overcoming Financial Setbacks

In the financial marathon, setbacks are inevitable. Market crashes, job loss, or unexpected expenses can disrupt one’s financial stability. However, maintaining a resilient mindset and having a contingency plan can help overcome such setbacks.

Building an emergency fund for unexpected expenses, having adequate insurance coverage, and diversifying investments can mitigate the impact of financial setbacks. Additionally, seeking support from a financial advisor or counselor during challenging times can provide valuable insights and guidance to regain stability.

9. Continual Education and Research

Financial literacy is crucial in navigating the challenges of money-making. Investing time in learning about personal finance, understanding concepts like budgeting, investing, and tax planning helps individuals make informed decisions and avoid common pitfalls.

Continually researching and staying updated with the ever-changing economic landscape and financial markets empowers individuals to adapt their strategies and optimize their financial decisions. Reading books, attending seminars, or following trusted financial experts can contribute to expanding knowledge and gaining new perspectives.

10. Cultivating Healthy Money Mindset

One’s attitude towards money significantly influences financial outcomes. Cultivating a healthy money mindset involves reframing perspectives on wealth, embracing abundance, and focusing on long-term goals. Avoiding impulsive purchases, celebrating small financial victories, and practicing gratitude for what one already possesses can foster a positive relationship with money.

Shifting the focus from instant gratification to long-term financial well-being encourages individuals to make better financial choices, resist unnecessary spending, and build a solid financial foundation.

Frequently Asked Questions

Q: Is it possible to achieve financial success quickly?

A: While some fortunate individuals may experience rapid financial success, the journey to long-term financial stability and wealth requires consistent effort, strategic planning, and determination.Q: Should I prioritize paying off debt or saving for retirement?

A: The decision depends on individual circumstances. High-interest debt should usually be prioritized, but it is also essential to start saving for retirement early to benefit from compounding interest.Q: How can I start investing with limited funds?

A: There are various investment options available for individuals with limited funds, such as low-cost index funds or starting with a micro-investing platform. It is essential to research and understand the risks associated with each option.References:- The Balance: https://www.thebalance.com/- Investopedia: https://www.investopedia.com/- NerdWallet: https://www.nerdwallet.com/